In a captivating episode of the All-In Podcast, billionaire Chamath Palihapitiya defies the rising tides of uncertainty surrounding the US dollar, declaring its unwavering status as the world's premier reserve currency. Despite the growing clamor from BRICS countries to break free from the shackles of the USD, Palihapitiya remains steadfast in his conviction.

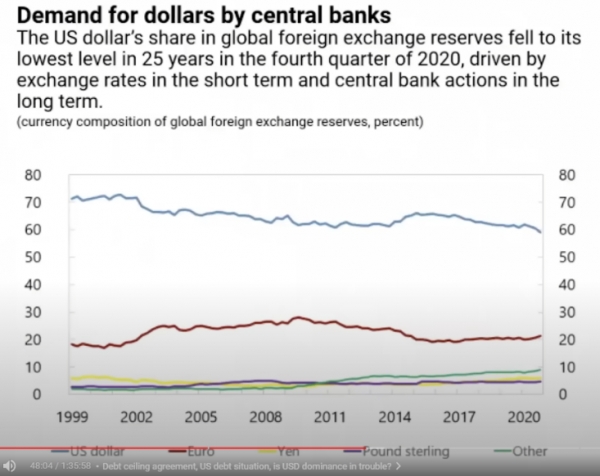

Citing data from the International Monetary Fund (IMF), Palihapitiya underscores that the US dollar has consistently accounted for a substantial 60% to 70% of central banks' foreign exchange reserves since 1999. He emphasizes that it is not merely US treasury securities that should be examined, but also the absolute dollar reserves—actual physical money. Surprisingly, this figure has displayed a remarkable stability over time.

Palihapitiya suggests that foreign central banks and governments are likely to continue amassing US dollars in the future, despite BRICS nations actively seeking alternative currencies for trade settlements. He observes that foreign reserves are increasing, indicating a strong inclination towards accumulating US dollars.

Addressing the efforts of BRICS countries to settle trades in yuan, Palihapitiya highlights that the yuan is effectively pegged to the US dollar, making it a proxy for the dollar. To achieve true decoupling, he argues that the yuan would need to float freely, which is unlikely as the Chinese government currently restricts its movement. Palihapitiya believes that the global economic circumstances further reinforce the US dollar's role as the anchor currency.

BRICS, consisting of Brazil, Russia, India, China, and South Africa, was initially established as a counterbalance to the dominance of the US dollar in the global financial system. However, Palihapitiya suggests that the dollar's position as the anchor currency for governments and central banks will persist in the foreseeable future.